Selling a House with Fire Damage in Pennsylvania

Sell Your House Fast To A Trusted Local Home Buyer For The Highest Price Without A Realtor

Receive a Fair & FREE

No Pressure Cash Offer

Simply Call Us Or Fill in The Form Below For Your No Obligation “As-Is” Cash Offer!

Free Offer Form

Sell Fire Damaged House in Pennsylvania

Dealing with a fire-damaged house can be a nightmare for any homeowner. The thought of selling such a property might seem impossible, but is it really? In this blog post, we’ll explore the ins and outs of selling a house with fire damage, revealing the challenges and opportunities that come with it. We’ll also provide valuable insights and strategies to help you navigate this unique selling situation with confidence.

So, whether you’re a homeowner struggling with a fire-damaged property or an investor looking for a new opportunity, this blog post is for you. Let’s dive in and uncover the secrets of selling a house with fire damage!

Visit The How it Works

Learn how our process works. We show you a real case study of a house we bought in cash.

Learn About Our Company

Find out who we are & make sure you’d feel comfortable selling us your home.

Request Your Cash Offer!

Fill in the form or call us. We will get with you ASAP to get your offer started!

Sell Fire Damaged House for Cash Quick

Sell Your House Fast, To A Legitimate House Buying Company You Can Count On. ✔️ Free, Easy & ✔️ No Pressure Process. Find Out How We Buy Houses!

We Buy Homes With Fire Damage In Pennsylvania

Adams County, Allegheny County, Armstrong County, Beaver County, Bedford County, Berks County, Blair County, Bradford County, Bucks County, Butler County, Cambria County, Cameron County, Carbon County, Centre County, Chester County, Clarion County, Clearfield County, Clinton County, Columbia County, Crawford County, Cumberland County, Dauphin County, Delaware County, Elk County, Erie County, Fayette County, Forest County, Franklin County, Fulton County, Greene County, Huntingdon County, Indiana County, Jefferson County, Juniata County, Lackawanna County, Lancaster County, Lawrence County, Lebanon County, Lehigh County, Luzerne County, Lycoming County, McKean County, Monroe County, Montgomery County, Montour County, Northampton County, Northumberland County, Perry County, Philadelphia County, Pike County, Potter County, Schuylkill County, Snyder County, Somerset County, Sullivan County, Susquehanna County, Tioga County, Union County, Venango County, Warren County, Washington County, Wayne County, Westmoreland County, Wyoming County, York County.

Wondering If You Can Sell A Fire Damaged House In Pennsylvania?

Yes, you can sell a fire damaged house. However, the process can be challenging due to the extent of damage and potential buyers’ concerns. The key to a successful sale lies in being transparent about the previous fire damage and disclosing all the necessary information to potential buyers.

Selling a fire damaged property requires an understanding of the market, as experienced home buyers may be more willing to take on such a project. By being upfront about the fire damage and the repairs performed, you can attract the right buyers and ensure a smooth selling process.

Who Buys Fire Damaged Houses In Pennsylvania (We Do!)

If you’re wondering who would be interested in buying a fire damaged property, look no further than real estate investors and companies that specialize in purchasing fire-damaged homes like ourselves. We as cash home buyers offer a quick and hassle-free solution by buying your house as-is, without you having to worry about costly repairs or dealing with real estate agents.

One such example is Fire Cash Buyers, a company that purchases fire damaged properties in various locations. By selling to cash buyer like them, you can enjoy the following benefits:

- An all-cash offer

- A quick closing

- Paying all closing costs

- You choose the closing date

- Relief from the hassle of dealing with cancelled contracts, clean up, managing general contractors, and the costs associated with agent fees and commissions.

Repair vs. Selling As-Is In Pennsylvania

When faced with a fire damaged house, you have two primary options: repair the damage or sell the house with fire damage as-is. Both options have their pros and cons, and the best choice depends on factors such as the extent of the damage, the cost of repairs, and your personal goals for the property.

Let’s explore the advantages and disadvantages of repairing fire damage.

Pros of Repairing

Repairing a fire damaged house can lead to a higher selling price and attract more potential buyers. By investing in repair fire damage restoration, you can maximize the market value of the property and make it more appealing to buyers looking for a home in “ready to move into” condition, including those who buy fire damaged houses.

The cost of repairing fire and smoke damage can be quite significant. According to the National Fire Protection Association, it can range from $2,853 to $37,491, with an average cost of $19,956. The extent of the damage and size of the fire will impact the cost of repairs, but it’s essential to weigh these costs against the potential increase in selling price to get the fair market value.

Cons of Repairing

While repairing a fire damaged house can potentially lead to a higher selling price, the process can be costly and time-consuming. Depending on the extent of the damage, repairs may involve:

- replacing walls

- roofs

- foundations

- reinforcing weakened structures

- repair costs

Moreover, the time it takes to complete the repairs can vary, lasting anywhere from a few weeks to several months. This extended timeline can be a major drawback for homeowners who need to sell quickly or are already dealing with the emotional stress of a house fire.

Pros of Selling As-Is

For those looking to sell a fire damaged house quickly and in a more cost-efficient manner, selling a fire damaged house as-is can be an attractive option. By selling as-is, you can avoid the costs and time associated with repairing the property and still find buyers who are willing to take on the project themselves.

Working with cash buyers can be particularly advantageous when selling as-is, as they often close quickly and without the need for inspections or appraisals. This can save you both time and money in the long run, especially when considering the actual cash value of the property.

Cons of Selling As-Is

On the other hand, selling a fire damaged house as-is may lead to a lower selling price and a smaller pool of potential buyers. This can be particularly true if the damage is extensive and would require significant time and resources to repair.

Furthermore, some buyers may be hesitant to purchase a fire damaged property, fearing hidden issues or potential health hazards. In such cases, you may need to work harder to find the right buyer or be willing to accept a lower selling price for your property.

Local home buyer Selling a House with Fire Damage, will do our best to make you an offer you’re happy with! Simply fill in the form below to get started. Our offer is 100% FREE & there’s no obligation to accept it 🙂

Free Offer Form

“Thank you for making it simple to sell my parent’s home. Words can’t express how emotional it was having to sell the house I grew up in. Thank you for being patient with my sister and me, for making the process simple, and for making us a decent offer instead of lowballing us like a lot of the other people that sent us letters did. You helped make the best out of a really horrible experience without the high pressure that some of the other buyers put on us.

The Hidden Residual Impact of Fire Damage In Pennsylvania

Fire damage is not always visible to the naked eye, and the hidden impacts can have significant consequences on the overall value and safety of the property. These hidden impacts include structural damage, smoke damage, and water damage, all of which can be caused by house fires.

We will discuss each of these in more detail below.

Structural Damage

Structural damage from a fire can compromise the integrity of the home and require extensive repairs. By uncovering and addressing this damage, you can improve the home’s structure and ensure its safety for future occupants.

Additionally, addressing structural damage can provide an opportunity to strengthen the structure of the home, making it even safer and more secure. It can also help identify any potential issues with the roof, walls, and foundation, allowing for repairs to be made before further damage occurs.

Smoke Damage

Smoke damage can cause lingering odors and health hazards within a property, making it crucial to address this issue through professional cleaning and deodorization. By removing smoke damage and odors, you can:

- Create a clean and fresh atmosphere

- Improve indoor air quality

- Eliminate potential health risks

- Increase the appeal of the property to potential buyers

Moreover, addressing smoke damage can also enhance the character of parts of the home that didn’t catch fire, adding a pleasant scent to:

- clothing

- furniture

- carpets

- other items in the home

This can further increase the property’s appeal to potential buyers.

Water Damage

Water damage from firefighting efforts can lead to additional problems, such as mold growth and the need for further repairs. Addressing water damage is essential to ensure the property is safe and secure before any restoration work can begin.

By performing water mitigation and drying out the home, you can:

- Prevent mold growth

- Prevent additional damage

- Improve the overall condition of the property

- Increase its appeal to potential buyers.

Mold Damage

Mold damage is a common residual effect of a house fire that often goes unnoticed until it becomes a more significant problem. During a fire, the water used to extinguish the flames can infiltrate building materials, creating a breeding ground for mold spores to thrive. The combination of moisture and lingering organic debris from the fire provides the ideal conditions for mold growth. As the moisture levels persist, mold colonies can develop within walls, ceilings, and other hidden areas, compromising the structural integrity of the property and posing health risks to occupants. Swift action to mitigate fire damage and prevent excess moisture is essential in averting the onset of mold and safeguarding the property from further harm.

Prior to Closing, a Cash Advance

Are you in need of fast cash? You're in luck! We not only offer fast closings, but we can also offer you some advance money even before you close! While we cover all the closing cost.

Professional & Compassionate Team

Our company has been buying and selling homes in CT since 2009. Over the past several years, we've closed almost 900 transactions, and our team loves helping people with their real estate needs!

We Specialize in Buying Inherited Properties

In case of need, we can cover the cost of Probate. In many instances, we buy inherited homes. The process can be handled by our dedicated Probate attorney free of charge.

Nothing Needs to be Repaired or Cleaned

No matter what condition your house is in, we'll buy it! We don't require sellers to disclose any information when they sell to us, so you can sell without concern.

We Can Help You Move & Find a New Home

Want to relocate before the closing? That's fine! Our free services include assisting you with the move and facilitating your move if necessary. We can buy your house fast.

Closing Date That Are YOU Choice

Is there a need for you to stay in your house AFTER the closing? Of course, we can accommodate your move to a new place! Let us take care of your closing cost as well!

Receive an Offer For Your Home That You Can ✅ Trust!

We Offer Cash Advances, Options & Flexibility Based on YOUR Needs!

Navigating Insurance Claims and Payouts In Pennsylvania

Dealing with insurance claims and payouts can be a daunting task, but it’s crucial to ensure you receive the compensation you deserve for fire damage. In this section, we’ll explore the process of filing claims, negotiating payouts, and understanding coverage to help you maximize your compensation.

Filing a claim is the first step in the process. You’ll need to provide the required information.

Filing Claims

Filing claims promptly and accurately is crucial for receiving insurance payouts for fire damage. To ensure a successful outcome, it’s essential to document the damage, secure the property, and file the claim with your insurance company.

Meeting with the insurance adjuster, verifying coverage, and providing documentation are all important steps in the claims process. By cooperating with the investigation and being thorough in your documentation, you can increase your chances of receiving the compensation you deserve.

Negotiating Payouts

Negotiating payouts with insurance companies can help homeowners receive fair compensation for fire damage repairs. By researching your insurance policy, documenting the damage, and contacting your insurance company, you can start the negotiation process confidently.

Knowing the extent of your coverage and the limits of your policy can help you negotiate a favorable payout, ensuring you receive the full compensation you deserve and minimizing any out-of-pocket expenses.

Understanding Coverage

Understanding your insurance coverage for fire damage is essential to ensure adequate compensation and avoid out-of-pocket expenses. Most insurance policies cover fire damage. Exceptions include arson and a structure negligently maintained.

Talking to your insurance agent right away can help you gain clarity on what is covered by your policy and how you can go about starting repairs. This knowledge can empower you to make informed decisions about repairing or selling your fire damaged property.

How to Sell a House with Fire Damage in Pennsylvania: A Step-by-Step Guide

Selling a house that has suffered fire damage presents unique challenges, but it's entirely possible, especially in Pennsylvania. Homeowners often feel overwhelmed, unsure of where to begin. This step-by-step guide is designed to demystify the process, helping you understand how to navigate the sale of your fire-damaged property effectively and make informed decisions along the way. Whether you're considering extensive repairs or selling as-is, knowing the correct procedure can save you time, stress, and potentially money.

The journey to selling your fire-damaged home in Pennsylvania involves several critical stages. From the initial safety checks and damage assessment to understanding your insurance policy, making crucial decisions about repairs, and finally, navigating the sale itself, each step requires careful consideration. We'll break down these stages, providing practical advice tailored to the Pennsylvanian market, ensuring you're well-equipped to handle this complex situation. Remember, companies like ours specialize in purchasing fire-damaged homes, offering a streamlined alternative to traditional sales.

Step 1: Prioritize Safety and Assess the Damage

Immediately after a fire, safety is paramount. Do not re-enter your home until authorities like the fire department deem it safe. Once cleared, your first action should be a thorough assessment of the damage. This isn't just a visual check; fire can cause hidden structural issues, smoke permeation, and water damage from firefighting efforts. Consider hiring a licensed public adjuster or a qualified contractor specializing in fire damage restoration in Pennsylvania to get an unbiased, detailed report. This report will be crucial for insurance claims and for understanding the true condition of your property.

Document everything meticulously. Take extensive photos and videos of all affected areas, both interior and exterior. Make a list of damaged belongings and structural elements. This documentation will be invaluable when dealing with your insurance company and when deciding on your selling strategy. Understanding the full extent of the fire's impact—from charred framing to soot and smoke odor in HVAC systems—will inform your next steps.

Step 2: Contact Your Insurance Company Promptly

Notify your homeowner's insurance provider about the fire as soon as possible. Review your policy to understand your coverage for fire damage, repairs, and potentially temporary living expenses. Your insurance adjuster will conduct their own inspection to estimate the repair costs. It's often beneficial to have your own independent assessment (as mentioned in Step 1) to compare with the insurer's findings.

Navigating insurance claims can be complex. Be prepared to provide all your documentation and communicate regularly with your adjuster. Understand the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage, as this will significantly impact your payout. If you encounter difficulties or feel the settlement offer is inadequate, you may need to negotiate or seek assistance from a public adjuster or an attorney specializing in insurance claims in Pennsylvania. This process is covered in more detail in our section "Navigating Insurance Claims and Payouts In Pennsylvania."

Step 3: Decide Your Selling Path: Repair or Sell As-Is

With a clear understanding of the damage and your insurance situation, you face a critical decision: should you repair the house before selling, or sell it in its current fire-damaged condition ("as-is")? In Pennsylvania, both options are viable, but they have different implications.

Repairing the home can potentially increase its market value, attracting a broader pool of traditional buyers. However, repairs can be costly, time-consuming, and stressful, especially if insurance payouts don't cover everything or if you're managing contractors. There's also no guarantee you'll recoup the full investment. Selling as-is, particularly to a cash home buyer or investor, is often faster and simpler. You avoid the hassle of repairs, and companies specializing in fire-damaged properties understand the risks and processes involved. Consider the pros and cons carefully, which are detailed further in our "Repair vs. Selling As-Is In Pennsylvania" discussion.

Step 4: Prepare for Sale (Focus on As-Is)

If you opt to sell your fire-damaged house as-is in Pennsylvania, preparation still matters, though it's different from a traditional sale. Honesty and transparency are key. You'll need to fully disclose the fire damage to potential buyers, as required by Pennsylvania law. Gather all relevant documents: fire reports, insurance claim details, and any inspection reports you've obtained.

While you won't be undertaking major renovations, ensure the property is safe for viewings if you're allowing them. This might involve boarding up dangerous areas or securing the property. For many sellers in this situation, the easiest route is to work with a cash buyer who is experienced with fire-damaged homes and may not even require extensive viewings or clean-up. These buyers, like us, purchase properties in any condition, removing the burden of repairs and cleaning from your shoulders.

Step 5: Marketing and Finding the Right Buyer

Marketing a fire-damaged home in Pennsylvania requires a targeted approach. Traditional methods like listing with a real estate agent on the MLS might not be the most effective, as many conventional buyers are deterred by the extent of work required. Agents may also be hesitant or lack experience with such properties, and their commissions can be substantial.

Consider alternative selling strategies:

- Cash Home Buyers/Investors: This is often the best choice. Companies that specialize in buying distressed properties, including fire-damaged homes, can make you a fast, fair cash offer. They buy "as-is," handle all the complexities, and can close quickly. This is our specialty.

- Auctions: Auctioning the property can sometimes generate competitive bids, but the outcome is less certain, and there are associated fees.

- For Sale By Owner (FSBO): While possible, selling FSBO is challenging for a fire-damaged home due to the complexities of valuation, disclosure, and finding qualified buyers.

Our "Selling Strategies for Fire-Damaged Homes In Pennsylvania" section delves deeper into these options, highlighting why selling to an investor is often the most advantageous path.

Step 6: Navigating Offers, Disclosures, and Closing in Pennsylvania

Once you receive an offer, review it carefully. For as-is sales to cash buyers, offers are typically straightforward, without repair contingencies. Ensure you understand all terms. Pennsylvania law requires sellers to disclose material defects, including fire damage, smoke damage, and any related water damage. Your real estate attorney or the title company can help ensure you meet all legal disclosure requirements using the Pennsylvania Seller's Property Disclosure Statement.

The closing process for a cash sale is usually much faster than a traditional, mortgage-financed sale. With a company like ours, we can often close in a matter of days or on a timeline that suits your needs. You'll sign the necessary paperwork, transfer ownership, and receive your funds. Selling a fire-damaged home can be emotionally taxing, but by following these steps and choosing the right partners, you can navigate the process successfully and move forward.

This comprehensive approach ensures you are well-informed and prepared for each phase of selling your fire-damaged house in Pennsylvania.

Free Offer Form

Selling Strategies for Fire-Damaged Homes In Pennsylvania

Now that we’ve covered the ins and outs of fire damage and insurance claims, let’s explore the different strategies for selling a fire-damaged home. These strategies include selling to investors, auctioning the property, and working with real estate agents, each with its own set of advantages and disadvantages.

Selling to investors can be a great option for those who need to sell quickly.

Selling to Investors (Best Choice)

Selling a fire damaged house to investors is the best option for a quick sale and cash offer, without the need for repairs or dealing with real estate agents. Investors, such as cash home buyers, can offer a hassle-free solution by purchasing your house as-is and providing you with a fair cash offer.

The process of selling to investors is straightforward, involving a cash offer and a quick closing. By choosing this option, you can avoid the time-consuming and major repairs associated with other selling strategies and focus on moving forward with your life.

Auctioning the Property (Ok Choice)

Auctioning the property can result in a fast sale but may not yield the desired selling price. While the auction process is quick and efficient, it can be somewhat unpredictable, and the final selling price may not meet your expectations.

However, if your primary goal is to sell the property quickly and you’re willing to accept the potential drawbacks in terms of selling price, auctioning the property may be a viable option. Just be sure to prepare yourself for the uncertainties that come with this selling strategy.

Working with Real Estate Agents (Worst Choice)

Working with real estate agents can be beneficial for repaired homes, but may be less effective for selling fire-damaged homes as-is. Traditional real estate agents may not have the experience or resources to handle the unique challenges of selling a fire damaged property, and their fees and commissions can add to your expenses.

If you choose to work with a real estate agent, be prepared to invest in repairs and be patient with the selling process. While this option can potentially yield a higher selling price, it may not be the most efficient or cost-effective strategy for selling a fire-damaged home.

Pennsylvania Real Estate Market Activity

Average Home Value:

- The average home value in Pennsylvania is approximately $266,551, reflecting a 4.3% increase over the past year as of February 2025.

Median Home Price:

- The median home price in Central Pennsylvania reached $280,000 in February 2025, marking a 7.2% increase compared to the same month in 2024.

- In January 2025, the median home price in the 17512 area was $242,200, up 6.2% from the previous year.

Sales Activity:

- Closed sales in Pennsylvania decreased by 4.0% year-over-year in February 2025, with 1,553 homes sold.

- New pending sales were down by 5.7% compared to the previous year, indicating a slowdown in market activity.

Inventory Levels:

- There were 1,898 new homes on the market in February 2025, which is a 7.4% decrease from the previous year.

- Total active listings increased to 3,061 homes, up 11.3% from February 2024.

Market Trends:

- The Pennsylvania real estate market is shifting towards a more stable environment with slower price growth and homes selling closer to their asking prices.

- Mortgage rates are finally declining after years of increases, which may encourage more buyers to enter the market.

Days on Market:

- Homes in Pennsylvania are typically going pending in around 19 days as of early 2025.

Thanks for buying my Mother’s home. It was a big help that you were able to buy it without us having to clean it out and get it ready to sell. My mother had accumulated lots of stuff and after the stress of her long illness I was exhausted and I dreaded dealing with all of it. I also liked it that you gave me a very fair price for the home. I’m on a fixed income and that really helped a lot.

Disclosing Fire Damage To Potential Buyers In Pennsylvania

Disclosing fire damage to potential buyers is crucial for transparency and compliance with state disclosure laws. By being upfront about the extent of the damage and any repairs performed, you can build trust with potential buyers and ensure a smooth transaction. All in all you have to disclose fire damage.

Providing detailed information about the fire damage, including the cause, extent, and any adherence to codes and standards during repairs, will give potential buyers the confidence they need to make an informed decision. This transparency can ultimately contribute to a successful sale and a positive experience for both parties.

Should You Sell Your Burned House Home As Is In Pennsylvania

Selling a fire-damaged house may seem like a daunting task, but with the right knowledge and strategies, it’s entirely possible. By understanding the hidden impacts of fire damage, navigating insurance claims and payouts, and choosing the best selling strategy, you can successfully sell your fire-damaged home and move forward with your life.

Remember, the key to a successful sale lies in transparency, proper disclosure, and finding the right buyer for your unique property. Armed with the information and insights provided in this blog post, you’re now ready to tackle the challenges of selling a fire-damaged house with confidence.

Selling a Fire-Damaged House in Pennsylvania: FAQs and Common Questions

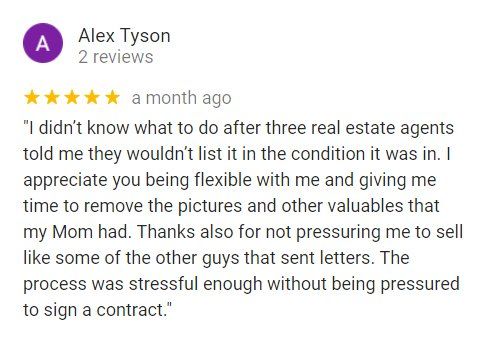

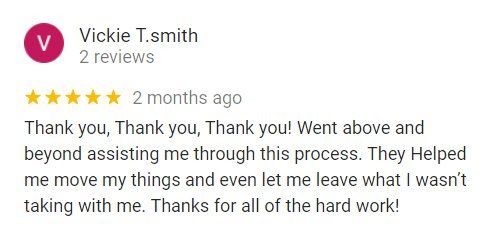

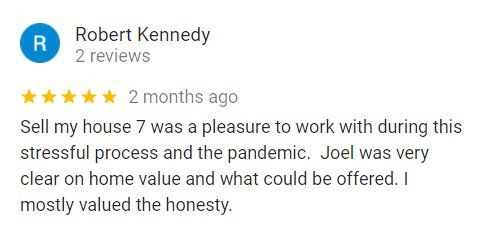

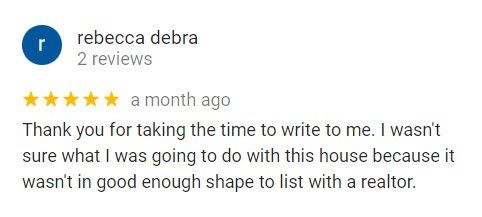

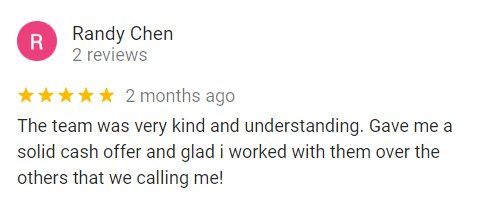

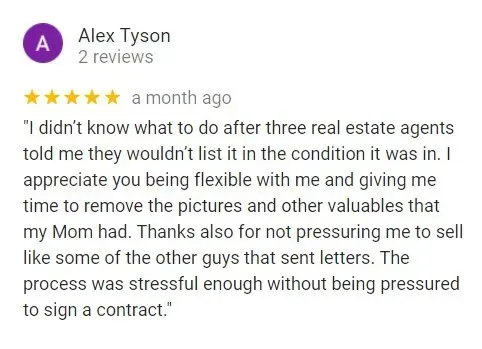

100+ Happy Online Reviews

We Must Be Doing Something Right!

So Many People Happy About Our Services – We Know You’ll Be Happy Too!

There’s ZERO Risk for You to Contact Us & Get an Offer – You Can Always Says “No”!